“US and Asian Markets Fall as AI Stocks Slide”

US and Asian Markets

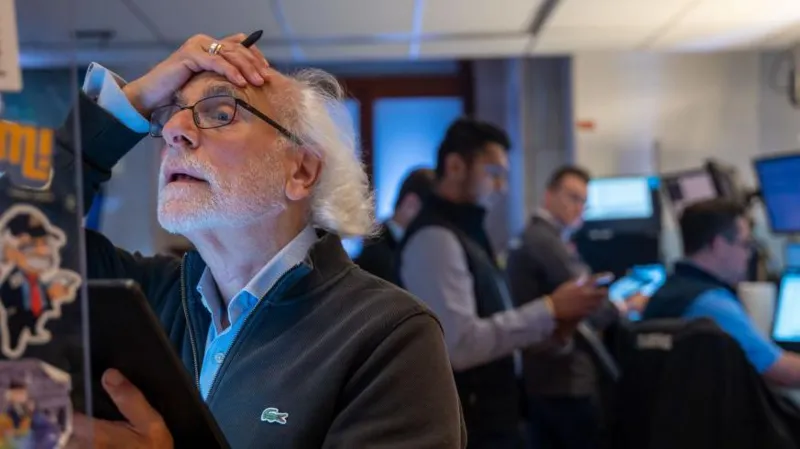

US and Asian Markets Monetary business sectors in the US and Asia have fallen pointedly. Financial backers auction partakes in innovation organizations. With computerized reasoning (simulated intelligence) stocks hit especially hard.

In Wednesday’s trading New York, the S&P 500 lost 2.3% and the tech-significant Nasdaq fell 3.6%, in their most noteworthy one-day falls beginning around 2022. The Dow Jones Modern Normal dropped by 1.2%. US and Asian Markets

The misfortunes were driven by significant firms including Nvidia, Letters in order, Microsoft, Apple and Tesla.

On Thursday, Japan’s Nikkei document driven diminishes in Asia. It fell by more than 3%.Shares in innovation organizations. Particularly those connected with computer based intelligence. Have driven quite a bit of the current year’s financial exchange gains.

Simulated intelligence chip monster Nvidia, which has been one of the principal recipients of the simulated intelligence blast. Saw its portions drop 6.8%. It has lost around 15% of its worth over the most recent fourteen days.

The organization is set to report monetary outcomes toward the finish of August. US and Asian Markets

Shares in multi-extremely rich person Elon Musk’s electric vehicle producer Tesla dropped by over 12% after its most recent monetary outcomes frustrated financial backers.

Google and YouTube parent organization Letters in order’s stock cost was 5% lower. Recently, the organization detailed monetary outcomes that beat expert assumptions yet its spending would remain high until the end of 2024.

Letter set, in the same way as other of its rivals, has been siphoning billions of dollars into the turn of events and reception of man-made intelligence innovation.

chip creators Renesas Hardware

In Asia, chip creators Renesas Hardware and Tokyo Electron in Japan and South Korea’s SK Hynix were among the enormous fallers.

“Jun Bei Liu from Tribeca Investment Partners mentioned concerns about AI spending without financial gains.”

I don’t think this will stamp the beginning of the skepticism in simulated intelligence… it essentially implies financial backers will zero in additional on returns here than simply purchasing the entire area, she added.

Financial backers are likewise vigilant after significant amazements in the US official political race and the planning of a loan fee cut by the US national bank.