‘Important moment’ as interest rates cut to 5%

interest rates cut

interest rates The Bank of Britain’s lead representative said a choice to cut financing costs is “a significant second in time”. Yet cautioned individuals not to anticipate a sharp fall before very long.

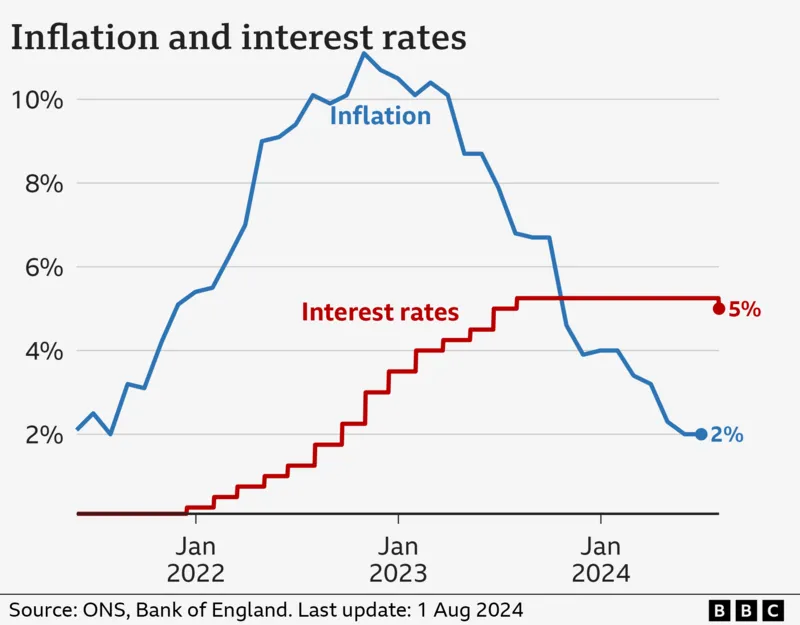

In a closely run choice, rates brought down to 5% from 5.25% on Thursday. Denoting the primary cut starting from the beginning of the pandemic in Walk 2020.

Loan fees direct the expense of acquiring set by High Road banks and cash moneylenders for any semblance of home loans and charge cards.

Bank lead representative Andrew Bailey said that lower expansion had prepared for the fall in loan costs. The BBC was told that it was “not a job well done at this point.”

He said policymakers required “to ensure expansion remains low and be mindful. So as not to cut loan fees excessively fast or by something over the top”.

Loan fees have move throughout the course of recent years. The Bank has combat to control taking off cost rises.

The higher rates have placed strain on family funds. Even though profits for savers have reached the next level.

The tumble to 5% implies that property holders on tracker home loans will see a quick decrease in their month to month contract installments. Those on factor rate arrangements may likewise profit from the fall.

Yet, numerous property holders on fixed rate contracts actually face the possibility of a lot higher home loan rates. When those arrangements terminate throughout the following couple of years.

There are trusts that falling financing costs will further develop customer certainty, which has been quelled.

Rupali Wagh, co-proprietor of Tukka Tuk road food in The Cardiff Market, said the loan fee cut has caused her to feel “confident”. It will ultimately bring down the installments on her business advances and means. A few clients will have more discretionary cashflow.

Exchange has increased recently due to the hotter weather. A few clients were all the while requesting less and attempting less things from the menu.

“They’re exceptionally limited with what they spend. I have never had such countless discussions on the table about home loans and costs,” she said.

You can peruse more from individuals the BBC addressed about the expected effect on their funds here.

‘Limited time offer?’

Mr. Bailey was asked if the interest cut was a “limited time offer.” That is, will there be no more cuts after this?

He said that he has no view on the way of rates and that the Bank would choose from one gathering to another.

Albeit on Thursday, monetary business sectors anticipated. That there was a 75% opportunity the Bank would cut rates again in November. After the Work government holds its most memorable Financial plan toward the finish of October.

The choice by the Bank’s nine-segment board was finely different – five, including Mr Bailey, managed for a quarter point cut. The Bank’s chief economist, Huw Pill, was among the four who voted to keep interest .

He later told a virtual question and answer that money related strategy. The move a national bank can make to impact the amount it expenses to get or save. Shouldn’t “take its eye off the ball” with regards to the cost for many everyday items.

“There are different instruments… That can be considerably more finely tuned. Substantially more carefully designated to assist with peopling deprived at the base,” he said.

Also, utilizing money related arrangement [in that way] may degrade it from what it can really do.

He recommended financial arrangement’s responsibility is to help the less wealthy by keeping expansion at 2%.

Bank of Britain

While the financing cost cut will be a lift for certain property holders who have been crushed. The Bank of Britain flagged that a home loan shock actually lay ahead for other people.

Around 33% of individuals with a fixed-rate contract are as yet paying under 3%, in the wake of getting it. When loan fees were significantly lower. Breaking todays

The Bank said that a large portion of these home credits will terminate before the finish of 2026 “implying that viable loan fees will rise to some degree further over that period”.

The expansion rate – which estimates the speed of cost ascends for labor and products . Hit the Bank’s 2% objective in May and has stayed there. interest rates

In any case, center expansion, which strips out unpredictable components, for example, food and fuel costs, remains somewhat high. Also, the Bank anticipates that expansion should ascend in the last part of this current year as energy bills tick higher in the colder months.

The Bank noticed that wage development – which can demolish expansion – had eased back however would keep on observing it.

It doesn’t, notwithstanding, expect a new open area pay rise guaranteed by Chancellor Rachel Reeves to significantly affect expansion.

Ms Reeves affirmed offers of pay increments of somewhere in the range of 5% and 6% for public area staff remembering NHS laborers and educators for Monday.

In view of “back of the envelope” estimations, Mr Bailey recommended they would have a “tiny” impact.

Ms Reeves invited the rate cut however said that “a great many families” actually confronted higher home loan rates due to previous Top state leader Liz Bracket’s scaled down financial plan.

She added that the public authority was “taking the hard choices” to fix the economy following quite a while “of low development”.

However, Moderate previous head of the state Rishi Sunak guaranteed on X that Work’s “expansion busting public area pay rises” would seriously endanger further loan cost cuts.

On Monday, Ms Reeves guaranteed the Moderate government had left a £22bn “dark opening” in broad daylight funds and had not been forthright about this.

The Preservationists have dismissed this, asserting Work is laying the foundation for charge rises, which Ms Reeves has suggested in a meeting on the News Specialists web recording.

The Bank affirmed that it had been advised by the Depository about the figures on Monday before Ms Reeves offered her expression in the Place of Hall.